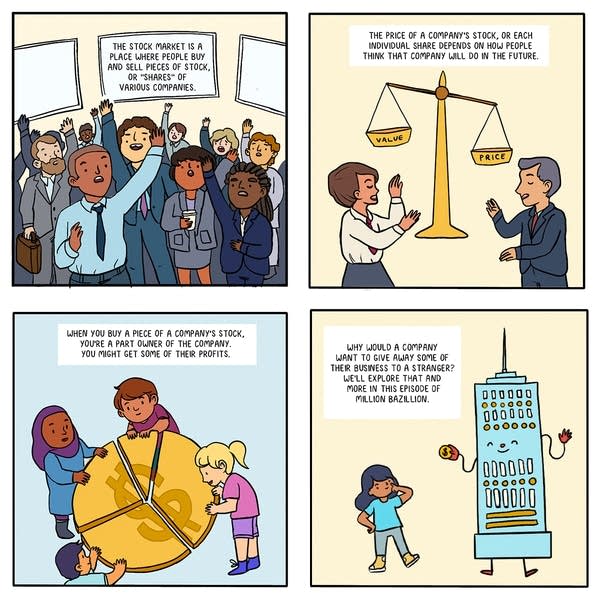

Companies need money to grow, and there’s a way for them to get it: the stock market. They can sell a little piece of their company, called a share or stock, to regular people. If the company grows, those people get to keep some of the money it makes. Of course, there’s no guarantee that a company will grow — that’s what makes putting your money in the stock market risky. On this week’s episode, we’ll explain how it all works with the help of some Dutch spice traders, comfy sneakers, a bull … and a bear! Plus, we’ll ask some random kids a not-so-random question or two, and we’ll sample Jed’s take on s’mores (AKA Bazillionaire’s Bounty).

Take a minute to recap the episode and review the key points. Here are some questions to get the kids going:

At the Million Bazillion campsite, what are the campers called?

Jed is very afraid of a certain kind of animal attacking the campsite. What animal is it?

Where did the Dutch East India Company start?

What were some of the risks that investors faced when they bought shares of the Dutch East India Company?

Complete the sentence: Aurelia bought a lot of shares of stock because she thought it was a rising ______ market, but it was really a massive ______ market, and prices were about to go down.

(Scroll down or click here for answers!)

The stock market can be confusing, even for adults. Here are a few more resources to help kids (and grown-ups) get their heads around how it all works:

Britannica Kids entry on “stock exchange”

Some excellent tips for parents from Beth Kobliner (author of “Get a Financial Life: Personal Finance in Your 20s and 30s”)

Some more expert tips if kids are asking about GameStop

We’re curious: What’s a money skill that you wish you had, or that you want to learn more about? Click here to tell us!

Silver Dollar Scouts

Badgers

The Netherlands

Answers will vary but could include: Pirates, bad weather, ships sinking, spices going bad, or simply the fact they’d have to wait 10 years before getting any money back

Bull, bear

The Ranzetta Family Charitable Fund and Next Gen Personal Finance, supports Marketplace’s work to make younger audiences smarter about the economy. Next Gen Personal Finance is a non-profit that believes all students benefit from having a financial education before they cross the stage at high school graduation.

Greenlight is a debit card and money app for kids and teens. Through the Greenlight app, parents can transfer money, automate allowance, manage chores, set flexible spend controls and invest for their kids’ futures (parents can invest on the platform too!) Kids and teens learn to earn, save, spend wisely, give and invest with parental approval. Our mission is to shine a light on the world of money for families and empower parents to raise financially-smart kids. We aim to create a world where every child grows up to be financially healthy and happy. Today, Greenlight serves 5 million+ parents and kids, helping them learn healthy financial habits, collectively save more than $350 million to-date and invest more than $20 million.

The Sy Syms Foundation: Partnering with organizations and people working for a better and more just future since 1985.